Editor’s note: this is a guest post from Aj Singh, Managing Director at ezyCollect. We’ve also added a few tips on relevant ServiceM8 add-ons!

You’ve spent time quoting, you’ve done the work, and now you’ve issued the invoice. You expect payment to hit your bank account any day, but it doesn’t arrive. Now you’re worried about how to pay for the supplies you need for the next job in the pipeline. Another sleepless night worrying about your mounting bills awaits you.

If this sounds like your business, you’re not alone. Preliminary findings from the inquiry into payments practices by the Australian Small Business and Family Enterprise Ombudsman finds almost 50 percent of small businesses experience late payments on at least half the bills owed to them. Almost 8 out of 10 say late payments are having a negative impact on mental wellbeing.

So how can business owners release the handbrake of late payments and get back in the driver’s seat of collections?

Here are seven habits to help you simply get paid, faster.

1. Keep a complete record of customer contact details

At some point, you’ll want to follow-up your overdue customers with reminders or even legal action. Make sure you have documented a number of ways to reach your customer: email, phone, SMS, post, even fax. Sending reminders will be much more effective if you have more than one way to communicate with your debtor. Your sales team are a good source to gather this data. And then you need a database to record and update this information.

2. Issue invoices promptly

Close the loop by invoicing immediately. Every day that an account is unpaid costs your business money. It’s money lost from working capital—that’s wages, rent, supplies, etc. Invoicing promptly means you stay ahead of the queue of other creditors waiting to be paid. If you’re never hands-free, you’ll need to think about how to outsource this: investigate the use of bookkeepers or technology.

3. Assess credit worthiness before issuing credit

Move out of auto-pilot and assess each significant credit customer for risk before issuing credit terms. If a big customer defaults or pays late, your business could be severely hampered. Add a business credit check report to your new customer checklist and receive insights into their credit transaction history. Seek a variety of trade referrals. For high risk customers, you can shorten credit terms or negotiate progress payments so you minimise the chance of late or default payment.

ServiceM8 tip: you can set different payment terms for specific clients with the Customer Payment Terms add-on:

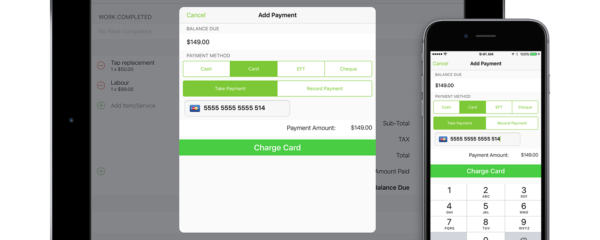

4. Accept online payments

Make it easy for your customers to pay you at any time of day or night by collecting money online. An online payment gateway—banks and non-banks provide these—allows you to accept credit cards as well as direct debit payments. For your customer, this gives them one-click access to depositing money into your bank account, especially if you add ‘Pay Now’ buttons to your invoices and reminder emails.

5. Systematically send follow-up reminders

Consistent, persistent, polite reminders work. They keep your invoice on your debtor’s radar, and they teach your debtor that you’re serious about being paid. Have a communications plan in place, so you know in advance what the follow up should be on Day 1 of an invoice being overdue, Day 10, Day 21 etc. Again, if desk time is a rarity in your line of work, think about how automation or outsourcing this task can save you time.

6. Invest in your customer relationships

Simple things like giving a great service and responding quickly to problems or complaints builds trust and respect between you and your customer, and that has a flow-on effect to how your invoices are treated. Thanking your customer after they have paid also shows them you are on top of your accounts, and sets you up for a great experience next transaction.

7. Instigate legal and debt collections agencies

This is the point where many small businesses stall in the collections process, simply because they don’t know who to call or what happens next. A legal demand letter can be as inexpensive as A$30. It doesn’t mean you and your customer need to end up in court, but it does keep the collections process moving forward.

Remember—you’ve earned the right to be paid on time. A few new habits, enacted across your business, will help you to reduce collection times and improve cash flow. And a good night’s sleep wouldn’t go astray, either.

Aj Singh

Aj Singh is the Managing Director and co-founder of ezyCollect, cloud-based automation software for debtor management. ezyCollect is a MYOB certified add-on and a Xero add-on. ezyCollect maps and tracks your accounts receivables and automates communication tasks such as sending follow up reminders and thank you messages. Users can also enable credit check reports, online payment gateways and legal and debt collection agencies.

0 Comments